Market Intelligence - Small & Micro Businesses, May 2020

For details on the source of this data and on our market intelligence project, please visit this page. Want to use these images on your site, or have us create other graphs for you from our data? They are available without the watermark in exchange for a link back from your site to acknowledge the source. Request copies or unique graphical data.

This month we review three of the best known UK marketplaces to list a business for sale:

Daltons Business

Rightbiz

BusinessesForSale

While we have data on the other portals, we are examining just these three today. Caveats on the below data at the bottom of this page.

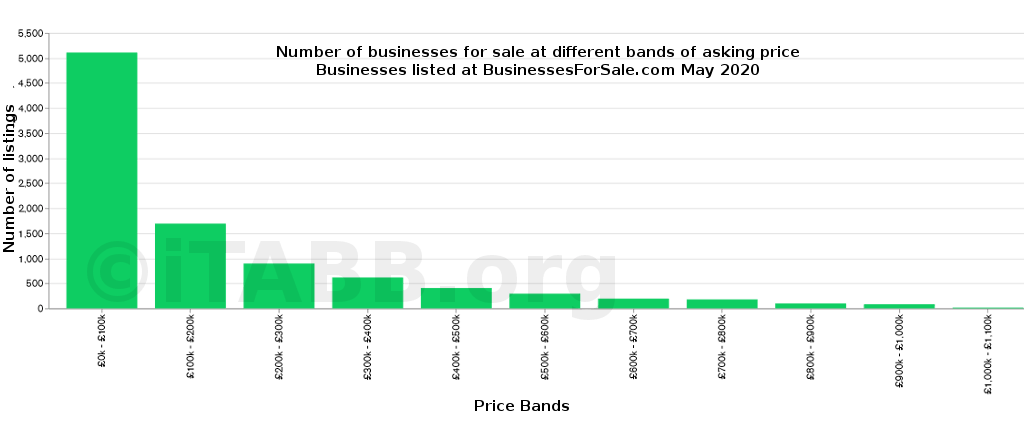

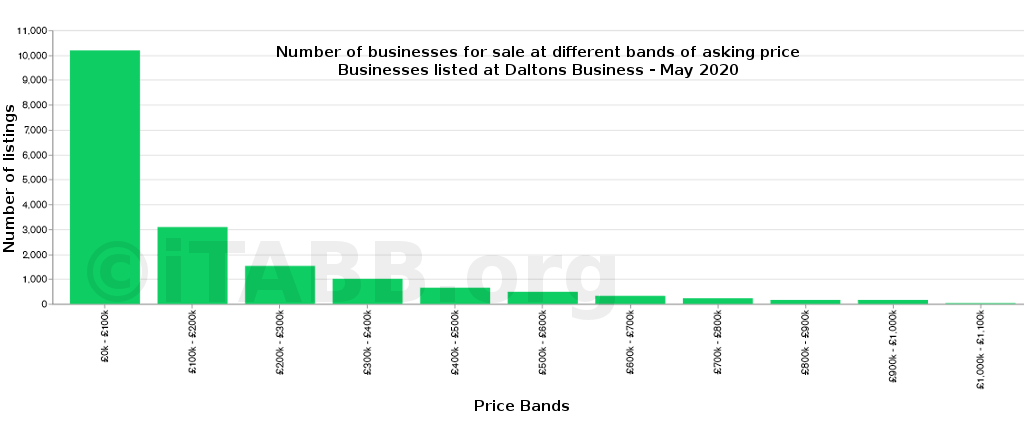

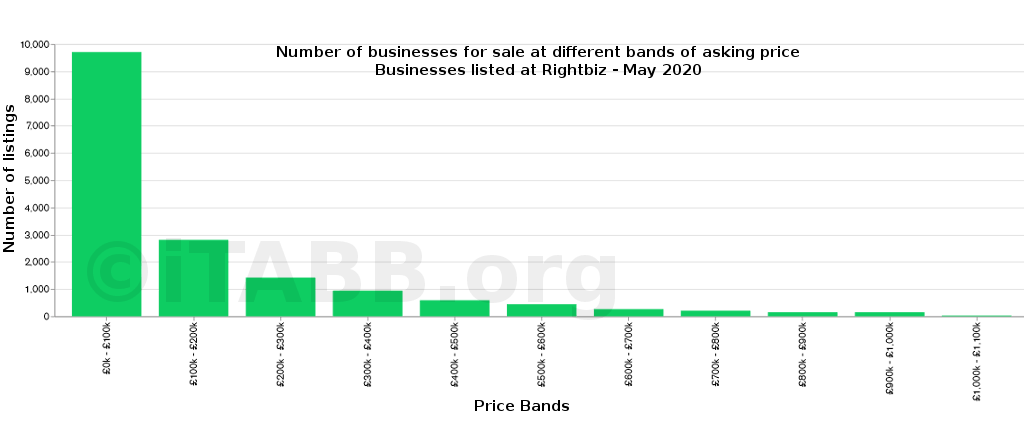

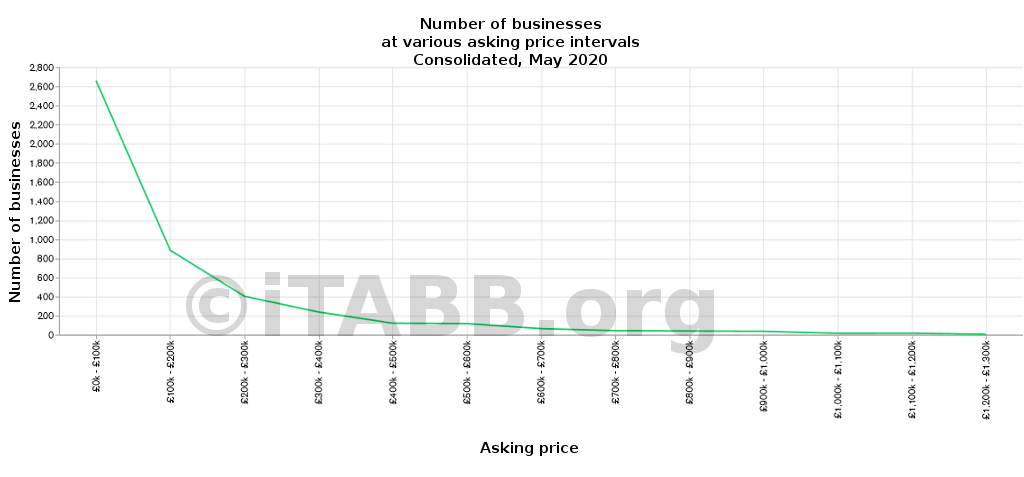

Number of businesses per asking price (bands with range of £100K)

At BusinessesForSale.com:

At Daltons Business:

At Rightbiz:

Caveats: Listings above £1 million have been excluded as they form such a tiny fraction.

The three platforms show roughly the same spread with about 55%-60% of listings having an asking price of under £100K, and about 75% of listings falling under the 250K mark.

As is obvious from the table below, Daltons and Rightbiz are roughly the same size in terms of number of listings with both boasting about 17,000 listings each (excluding the "new franchise" and other listings that are not businesses for sale).

BusinessesForSale is the smallest at a little over half the number of listings at the other two sites.

ASKING PRICE BANDS | Businesses For Sale.com | Daltons | RIGHTBIZ |

|---|---|---|---|

£0k - £100k | 5,104 | 10,192 | 9,692 |

£100k - £200k | 1,697 | 3,076 | 2,817 |

£200k - £300k | 903 | 1,517 | 1,407 |

£300k - £400k | 622 | 996 | 946 |

£400k - £500k | 407 | 640 | 597 |

£500k - £600k | 290 | 485 | 442 |

£600k - £700k | 193 | 317 | 278 |

£700k - £800k | 175 | 228 | 215 |

£800k - £900k | 101 | 150 | 149 |

£900k - £1000k | 83 | 156 | 138 |

£1000k - £100k | 16 | 28 | 27 |

TOTAL | 9,591 | 17,785 | 16,708 |

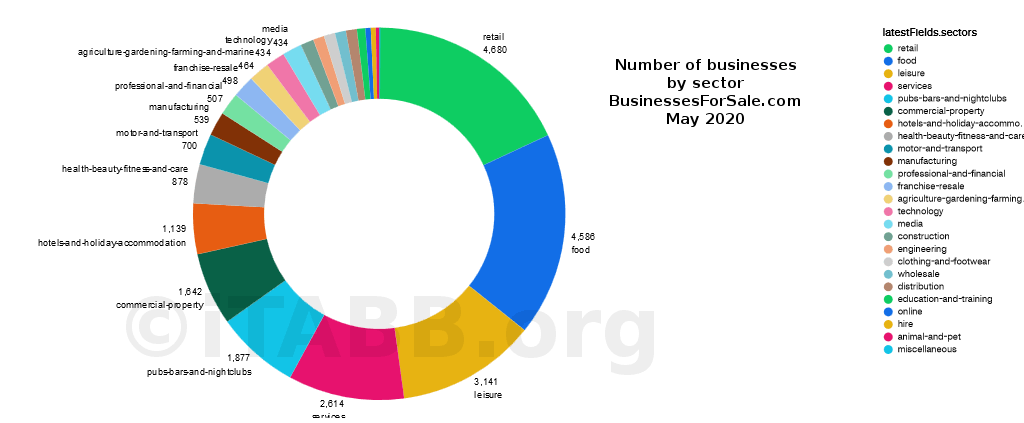

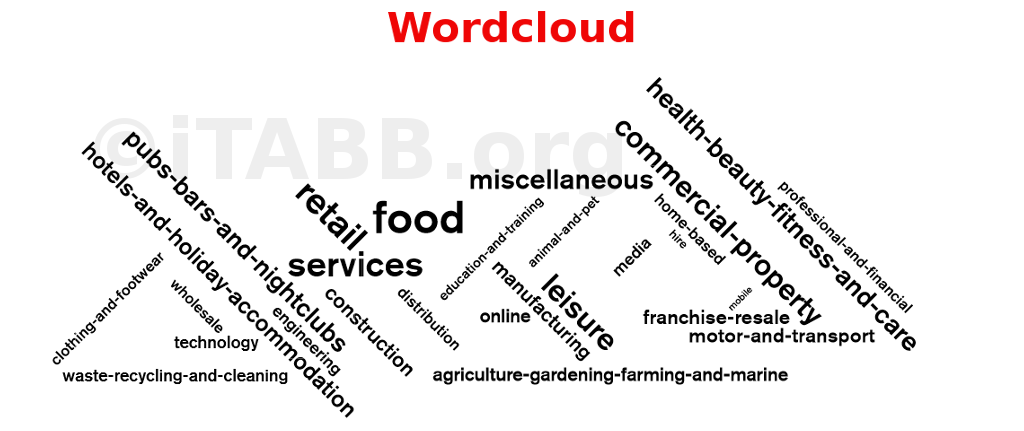

Businesses for sale by sector

At BusinessesForSale.com:

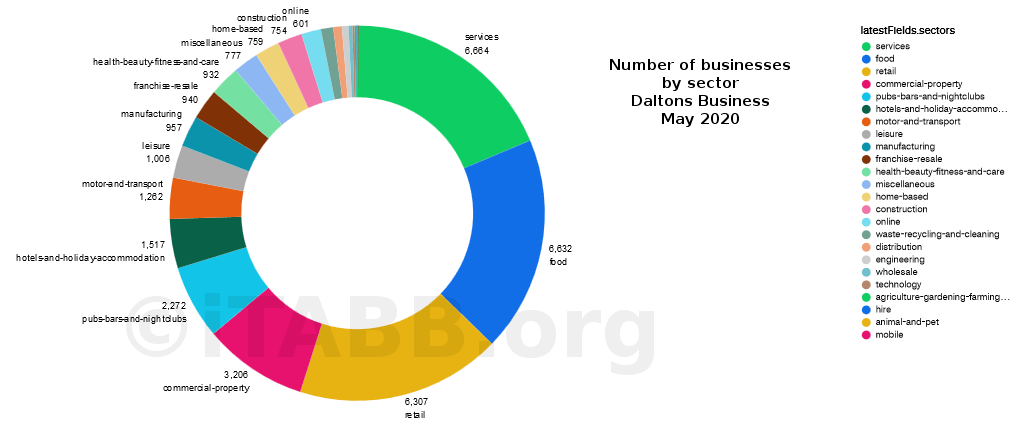

At Daltons Business:

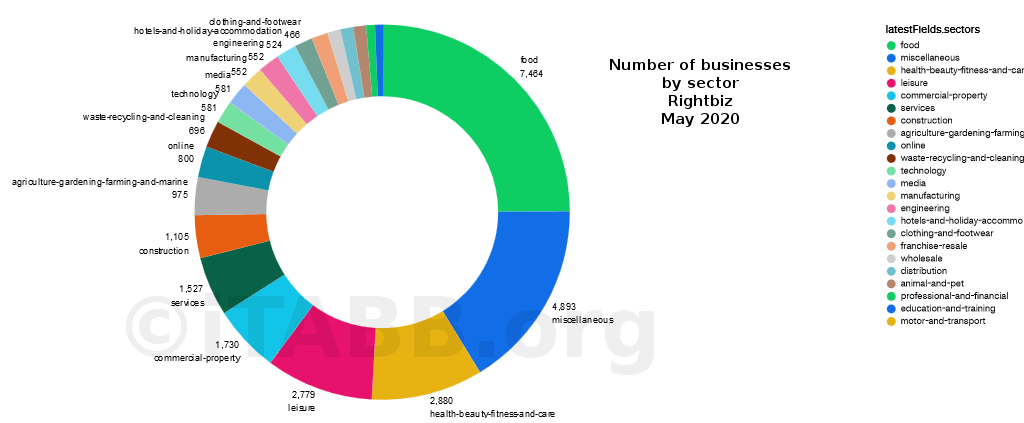

At Rightbiz:

Interestingly, they don’t all seem to attract the same kind of businesses.

The most popular sector at businessesforsale was retail followed by food.

At Daltons it was services followed by food.

Rightbiz is the only one where food was the most popular sector.

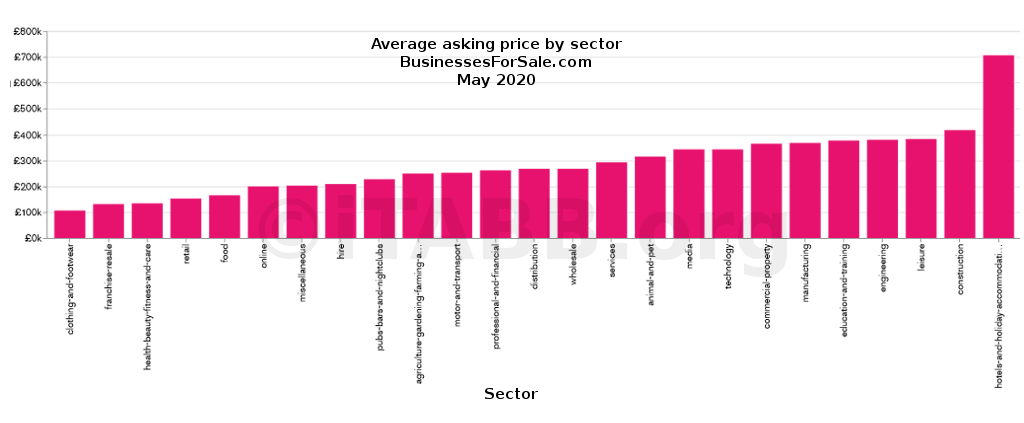

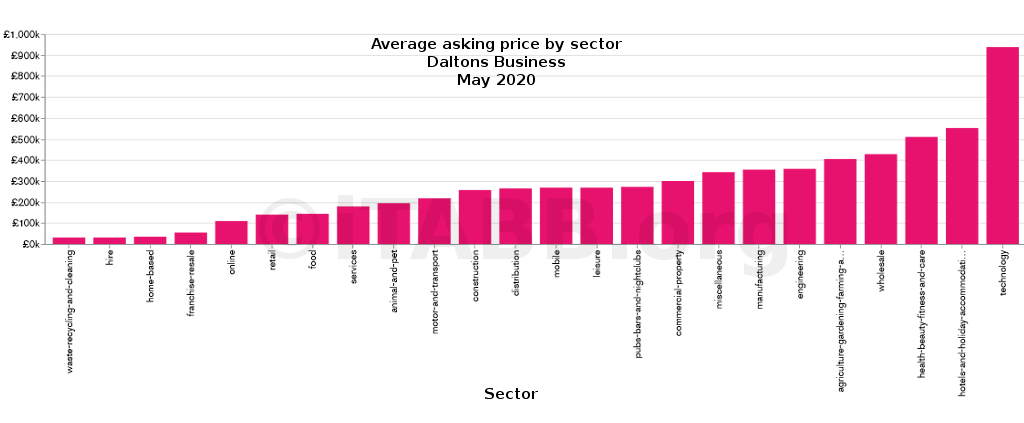

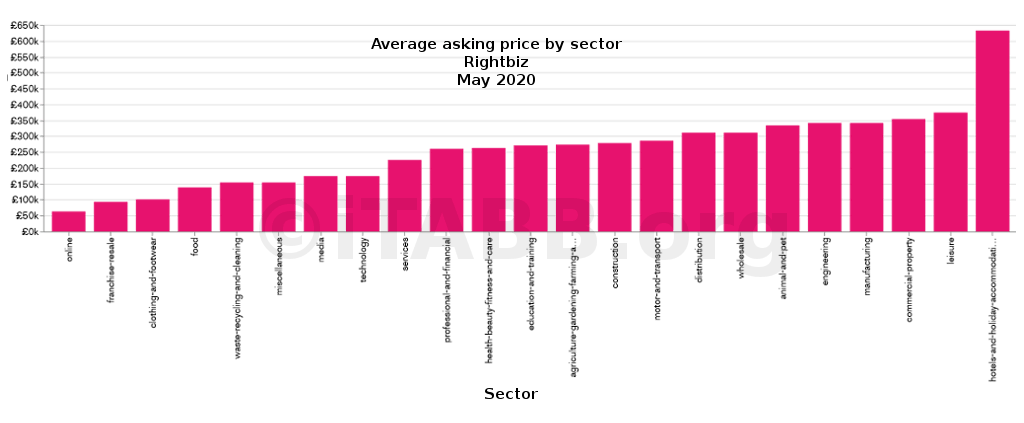

Average asking prices by sector

The highest average in Daltons seems to be for technology businesses while it’s hotels/hospitality for the other two. Hotels/hospitality makes sense as being the most expensive - they often come with freeholds, but why is Daltons showing a £1m average price for tech businesses? Is Daltons the go to site for large tech businesses?

Unfortunately, no. Daltons figures are being skewed by a single Midlands based software business listed by ETS Corporate. This is a business with £230K operating profit, £700K in assets and an asking price of £5.5m. Given the low number of tech businesses at Daltons, this one listing has skewed the average for tech businesses at this site. If that business is removed Daltons, too, has hotels and hospitality as the top sector.

Averages are terrible, aren’t they? Next time medians. Maybe.

At BusinessesForSale.com:

At Daltons Business:

At Rightbiz:

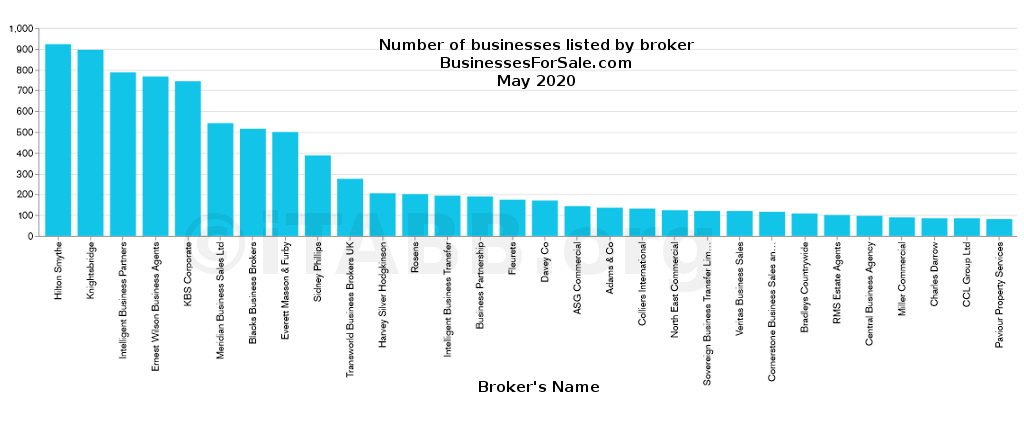

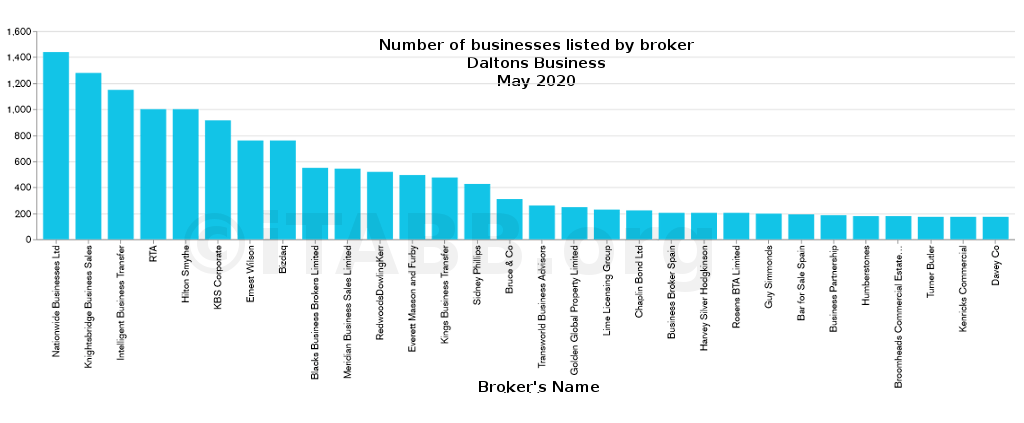

Which business brokers are listing the most businesses?

At BusinessesForSale.com:

We've included only the top 30 brokers on each platform. There are numerous brokers in the tail, some with just 2-3 listings each. Including them all would have made these charts unreadable.

At Daltons Business:

Rightbiz does not disclose to the general public the name of the broker behind each listing. So we found another way to get the names of the brokers behind listings. We are choosing to not disclose this data at this time. We may do so later.

Hilton Smythe are the clear winners at BusinessesForSale. Disclosure: Hilton Smythe are founding supporters of this site. That doesn't, of course, play any part in these stats.

There are one or two known anomalies in the below data that we haven't gotten around to cleaning yet, but they are broadly correct. Note that Knightsbridge / Knightsbridge Corporate are different companies but part of the same group. Bizdaq is not a broker but its own marketplace that "shares" its listings on other marketplaces. Entries like Business Partnership represent franchises. Their listings are accumulations of listings by all their franchisees.

The Top 30 Brokers

BusinessesForSale

Daltons Business

Hilton Smythe

Knightsbridge

Intelligent Business Partners

Ernest Wilson Business Agents

KBS Corporate

Meridian Business Sales Ltd

Blacks Business Brokers

Everett Masson & Furby

Sidney Phillips

Transworld Business Brokers UK

Harvey Silver Hodgkinson

Rosens

Intelligent Business Transfer

Business Partnership

Fleurets

Davey Co

ASG Commercial

Adams & Co

Colliers International

North East Commercial

Sovereign Business Transfer Limited

Veritas Business Sales

Cornerstone Business Sales

Bradleys Countrywide

RMS Estate Agents

Central Business Agency

Miller Commercial

Charles Darrow

CCL Group Ltd

Paviour Property Services

923

895

785

768

744

541

516

499

387

275

204

202

193

191

173

171

145

135

130

124

120

119

118

107

99

98

89

85

84

80

Nationwide Businesses Ltd

Knightsbridge

Intelligent Business Transfer

RTA

Hilton Smythe

KBS Corporate

Ernest Wilson

Bizdaq

Blacks Business Brokers Limited

Meridian Business Sales Limited

RedwoodsDowlingKerr

Everett Masson and Furby

Kings Business Transfer

Sidney Phillips

Bruce & Co

Transworld Business Advisors

Golden Global Property Limited

Lime Licensing Group

Chaplin Bond Ltd

Business Broker Spain

Harvey Silver Hodgkinson

Rosens BTA Limited

Guy Simmonds

Bar for Sale Spain?

Business Partnership

Humberstones

Broomheads Commercial Estate Agents

Turner Butler

Kenricks Commercial

Davey Co

1,441

1,279

1,147

1,002

999

917

758

757

548

544

521

496

478

424

309

262

249

230

225

205

204

201

200

191

187

181

181

176

174

173

You can reach any of the above brokers by searching for their name in our directory.

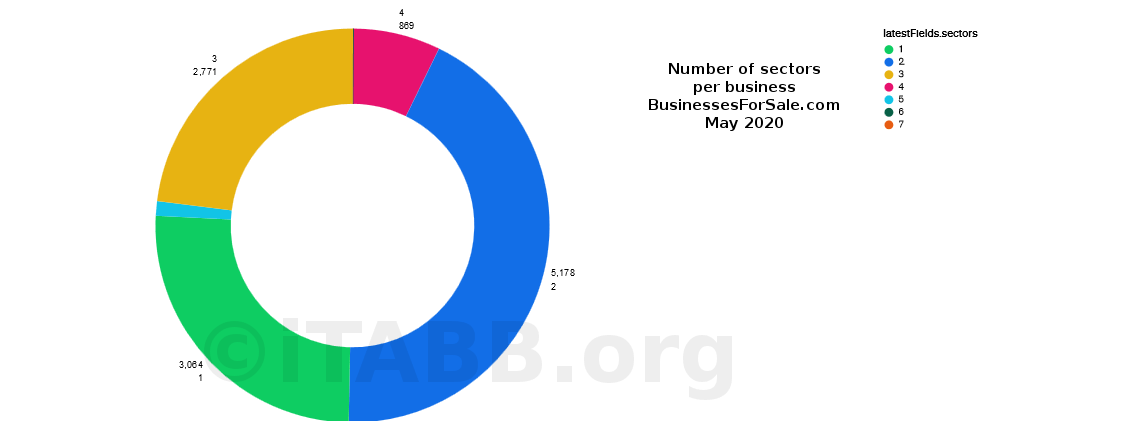

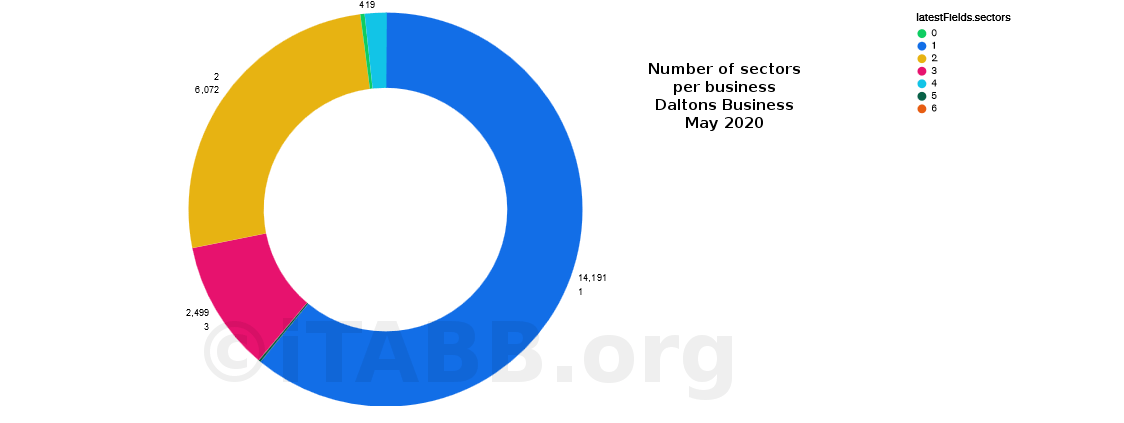

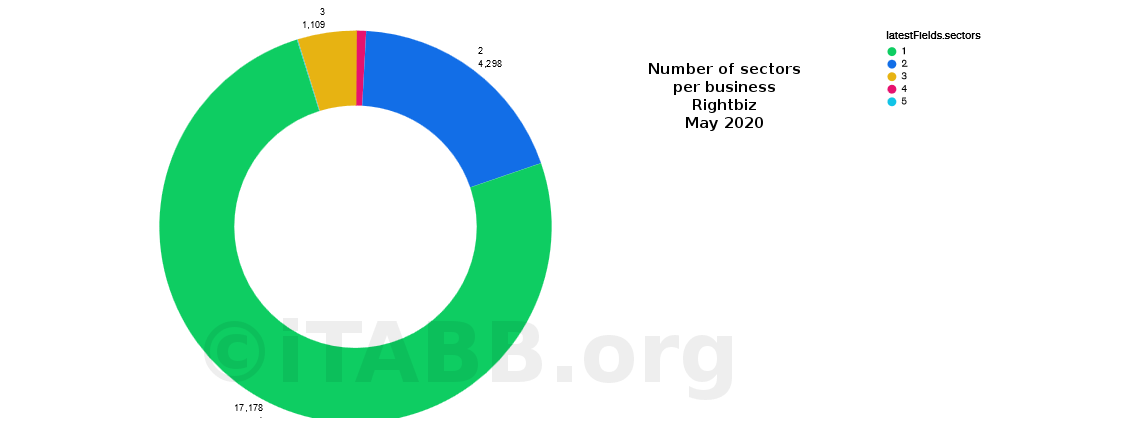

Number of sectors per business

Most businesses will probably qualify for a listing under more than one sector. However, multiple sector listing happens the most with BusinessesForSale, a bit less with Daltons and when it comes to RightBiz, 75% of listings were featured in only one sector.

From a buyer’s point of view there seem to be both pros and cons to businesses listing in multiple sectors. Buyers sometimes complain that at businessesforsale vendors often list their business under unrelated sectors just to get more views – sector spam if you will!

On the other hand, some buyers are interested in the wider sector and businesses that feature at the edge of that sector or arguably in multiple related sectors.

At BusinessesForSale.com:

At Daltons Business:

At Rightbiz:

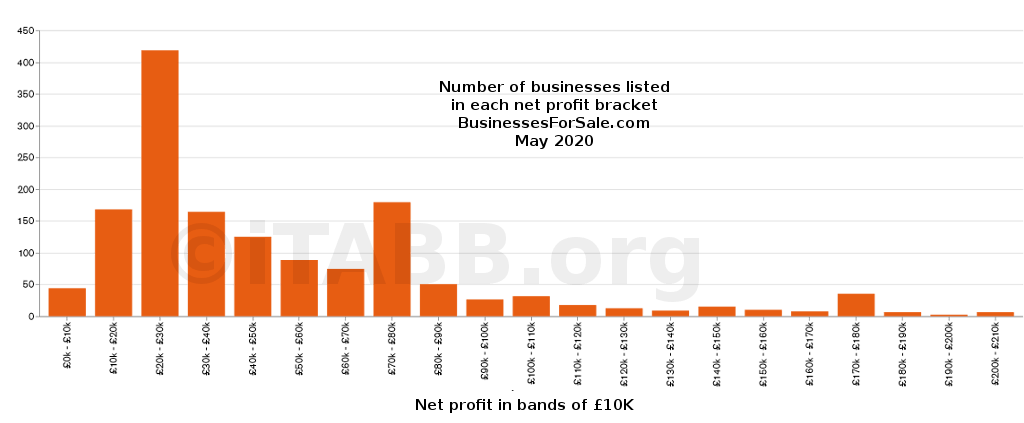

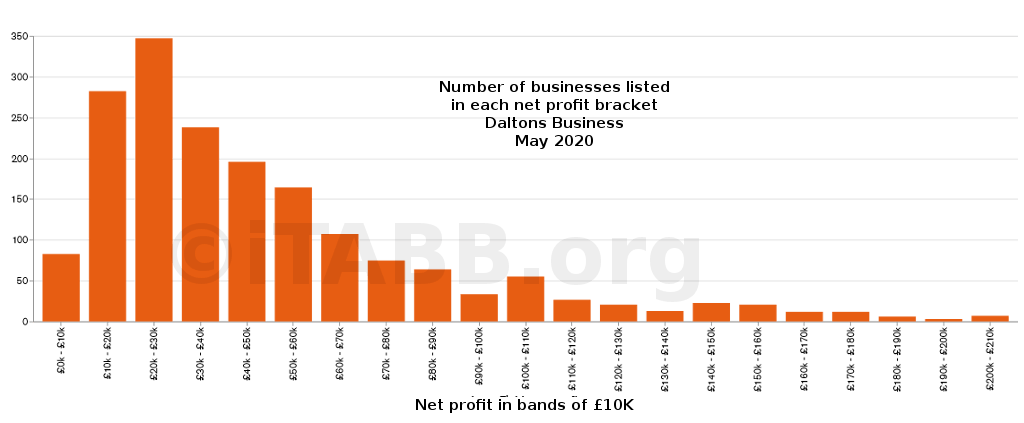

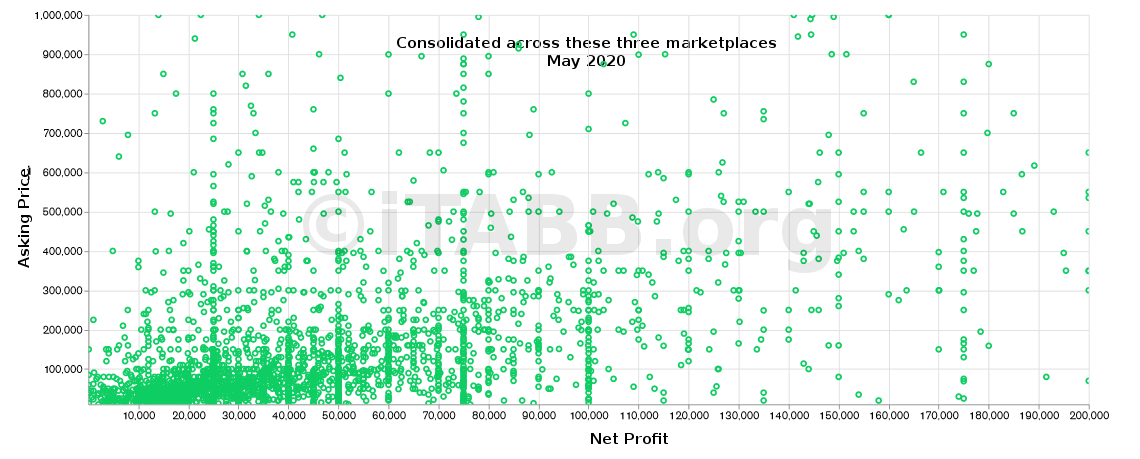

Businesses organised by net profit

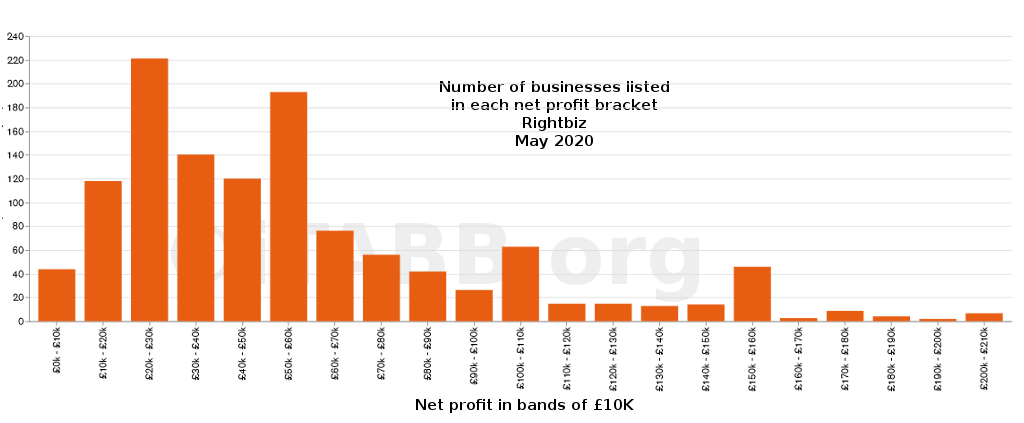

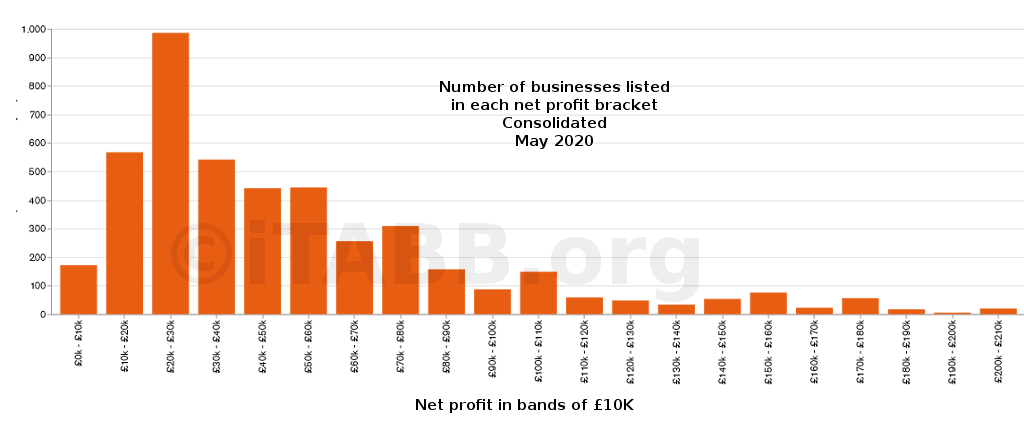

We truncated all results at £200K. There were hardly any businesses worth mentioning that claimed a net profit of over £200K.

All three platforms show a spike in the £20K - £30K range. Daltons and Rightbiz were tied with both showing 18% of their listings in this bracket, but at BFS 25% of the listings claimed a net profit of between £20K and £30K.

At BusinessesForSale.com:

At Daltons Business:

At Rightbiz:

One further graph on this – a consolidated one

60% of businesses are claiming a net profit of between £0 and £50K, 27% claim a net profit of between £50K and £100K and 8% claim £100K to £150K.

98.5% are claiming £0 - £500K and 1.5% say their net profit is above £500K.

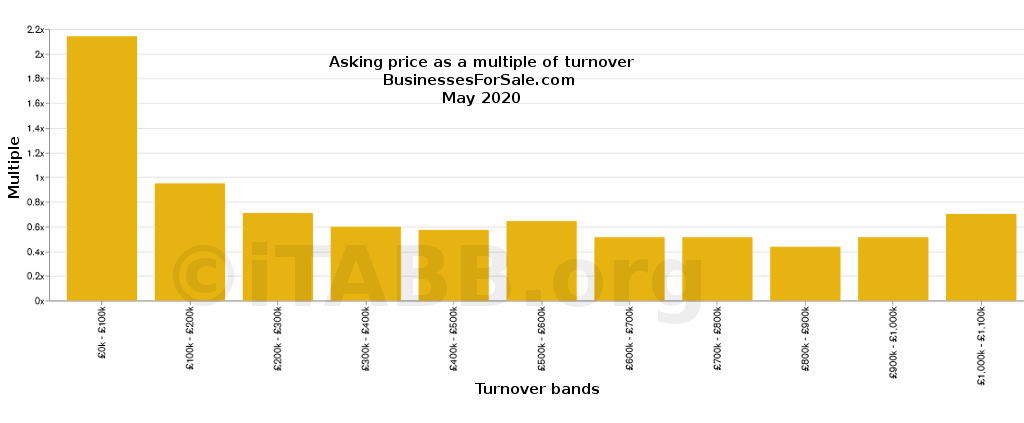

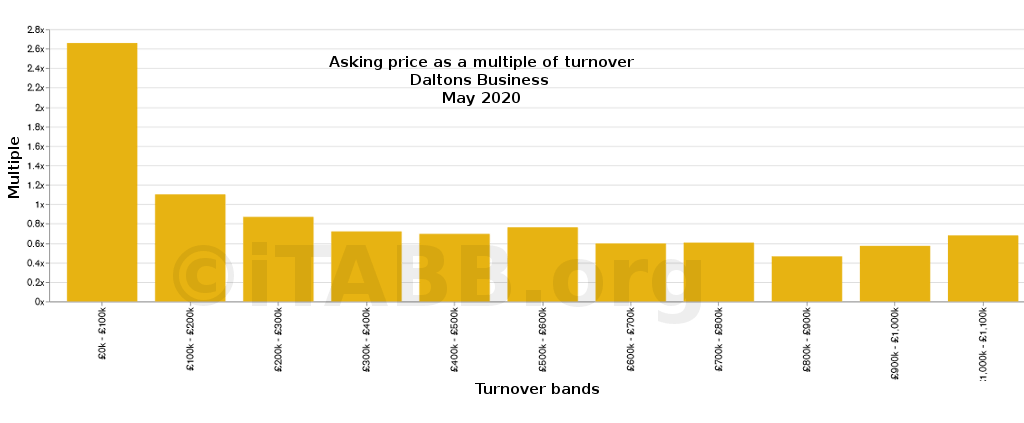

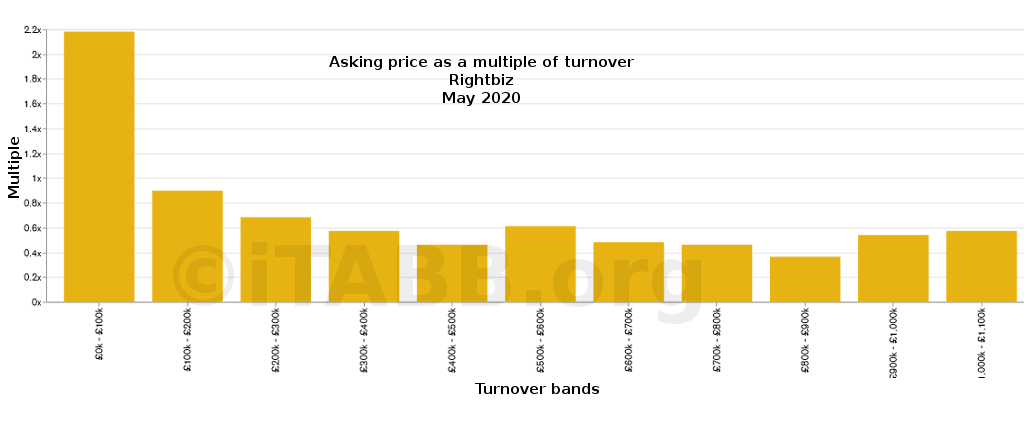

Average asking prices as a multiple of turnover

Sellers at the lower end of the range seem to be more ambitious at Daltons with an average asking price of 2.6x turnover. At the other two locations it’s roughly 2.2x turnover. In all cases, these smallest businesses seemed to have the highest price expectations (when calculated as a multiple of turnover).

We don't need to emphasise that these are asking prices, not selling prices. Not all businesses will sell at the asking price, if any. Some businesses are over priced and won't sell at all. In a future post we intend to analyse what percentage of businesses are still sitting on the shelf after 6 months, 12 months, 18 months. We may provide a breakdown by sector.

It might be also interesting to analyse, sector by sector, at what multiple (of profit) businesses are getting de-listed (which suggests that they have successfully sold).

While we produce asking price as a multiple of turnover, it’s not an indication that turnover has any part to play in the normal valuing of businesses. Turnover is vanity, profit is sanity, as the old saying goes.

About the below: We excluded businesses with turnover in excess of £1m as they constitute a tiny minority of listings on these three platforms. We also excluded those businesses asking for 30x or more of their turnover. A business with £0 turnover (like the new franchise opportunities) but an asking price of £20K or £50K would be meaningless in these calculations.

At BusinessesForSale.com:

At Daltons Business:

At Rightbiz:

What about average asking prices as a multiple of net profit? Isn't that how business values are normally quoted - multiple of EBITDA / profit / SDE? Maybe next time.

Some other general eye candy

Net profit vs asking price

Most popular words

Numbers of businesses at various asking price intervals

What about the x, what about y?

What about asking prices by sector? Are businesses in technology really asking for higher multiples than businesses in manufacturing?

Do private sellers have higher price expectations (as a multiple of profit) than do business brokers? Which business brokers are asking for the highest multiples and what's the average multiple they seek?

Maybe next time.

Thank you for reading.

ACKNOWLEDGEMENTS

All the technology behind this market intelligence project was created and managed by 17 year old Kaspar Lee. Congratulations, recommendations etc can be left for him at his LinkedIn profile: Kaspar Lee.