M&A Market Intelligence - Small Businesses

We run the a large scraping operation to collect data from all the main platforms / marketplaces where UK businesses are listed for sale. Every day our bots visit thousands of listings of businesses publicly advertised for sale and collect the data on each listing.

The data is cleaned, the fields tidied up etc., and information is saved in one consolidated database from where it can be analysed, dissected and otherwise manipulated to extract the kind of market intelligence and actionable data that's of use to business sellers, business buyers and agents handling the sale of businesses.

All the data disclosed publicly is collected ...and then some. For example, there are fields such as whether the business is freehold or leasehold, and whether the business is relocatable. Our bots collect those as well.

There are over 100 fields for each business that we track (and we are tracking every UK business that is publicly listed for sale at online marketplaces / portals).

As an example, buyers looking for only businesses where there is seller financing available often can’t filter based on their preference as marketplaces don’t give them this. We are able to compile such a list of opportunities where the seller of the business is willing to finance the deal. This list can be further filtered by sector, by geographical region etc.

There are, similarly, several other fields on which buyers would like to filter but are currently unable to – quite simply because the platforms do not offer that facility.

Even if any one platform offered more advanced search facilities, users can’t search across the whole ecosystem, they can search only one platform at a time. We are able to provide a UK wide view.

Thanks to the clever way our tech guy has organised the data, we can track changes to individual listings over time. We know when the price on a listing has dropped, for example. And we can set flags on any individual listing to notify us when there is a change in price (or a change in any other field).

Having a record of past drops in price can be useful for buyers to know what the seller's original expectations were and how they changed over time.

We are able to ascertain a lot more about individual listings than the marketplaces are disclosing to the public. For example, we can tell the age of a listing – when the advert first went live. This is not something any of the platforms disclose. Some buyers find it useful to know the age of listing. Their logic is that if a business has been online for long enough the owner may be getting increasingly desperate to sell and may be more flexible on price.

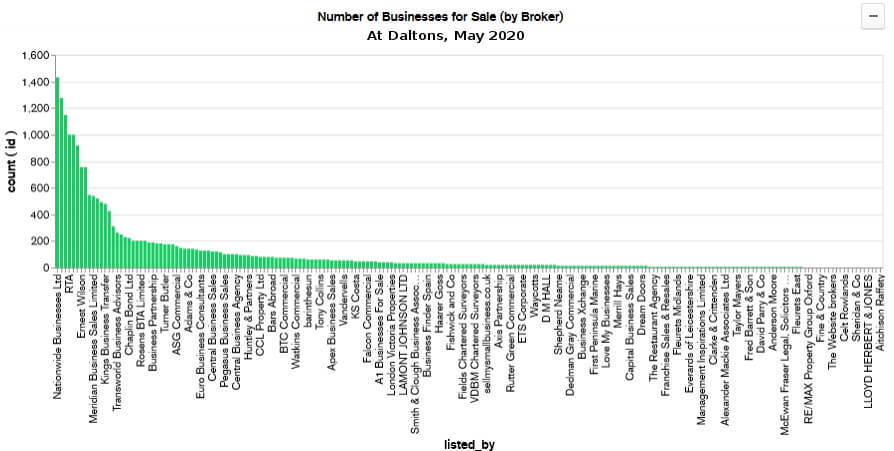

Some buyers prefer to deal with only those businesses being represented by a broker, other prefer those businesses being sold directly by the business owner/s. We are able to filter on these fields and produce, for example, a comprehensive, cross platform list of hair salons being sold in London via brokers rather than directly by business owners.

When a listing for a particular business is taken offline for a while (suggesting the business had an offer) and then comes back online again (suggesting the offer didn’t work out for whatever reason), it might help buyers to know this history.

Since we have data from all the main marketplaces we know if a business has been listed at multiple locations or just one. A business listed in just one location is likely to be getting fewer enquiries; buyers might find they have less competition for these businesses.

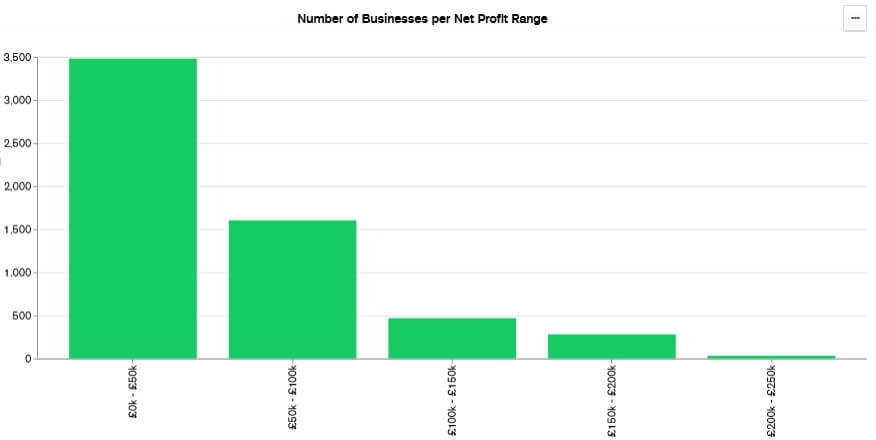

Our data is likely to be of use to sellers as well. Given we know highest, lowest, median and average asking prices as a multiple of earnings, this can serve as a guide to sellers who are deciding on a price at which to go to market.

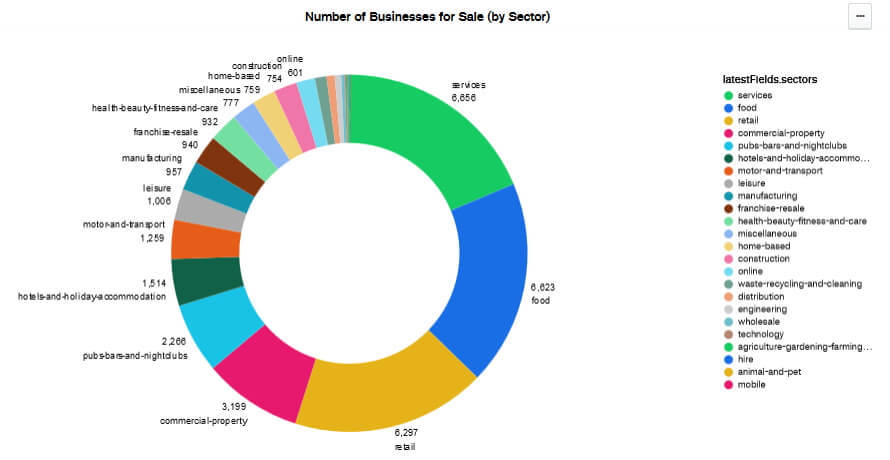

We can analyse average asking prices by sector, by geographical area, by various other metrics.

By tracking price drops of individual listings we can ascertain at which price point and which multiple each business was taken off the market. This gives an indication as to the price point / multiple at where deals may be happening in that sector.

We need your help

This project is very much in its initial stages and not ready for public access yet. In the meanwhile, we are going to be sharing some of the data we have.

But we need your help for ideas and suggestions on how this data could be useful to you. How can we manipulate the data to extract intelligence that you would find interesting and helpful? What burning question do you have that we may be able to answer? Tell us here.